Crypto Tales Part 2 - Down the Rabbithole We Go!

After the shocking Pre-Christmas dip in my holdings, I decided it was time to spread my investments about some more. Diversification and all, you know. But many exchanges seemed shady or had complex setups involving wallets and keys. These were things built for the hardcore users. Not for a casual investor such as myself. I was still not ready to get into the whole wallet thing, especially since I was looking at buying a number of coins. I also did not want to lose what coins I did have due to a hack or botched transfer. I needed the interactions with the exchange to be intuitive and clear. And most of all, I needed to feel like I could trust the exchange in question.

Binance, an exchange based in Singapore, was oft-mentioned as a preferred trading spot. So on Christmas evening, I took a look. The website was in English and looked clean, professional. I stepped into the account creation flow and after a surprisingly easy and painless setup, I was ready to go. The number of available coins and trading pairs was overwhelming. But I had come prepared. There was no real research done for these choices. I went with popularity and name recognition. Follow the masses! My reasoning was as follows -- if the coin was popular, it would get more press and mentions, and more people would buy it. This was a sort of doubling-down on my belief that Bitcoin would boom because it had plenty of press, but relatively few actual investors. I combed through threads on Reddit to create an initial list of the coins mentioned most often, especially in the innumerable threads asking for advice on where to invest. Then, I ran a basic Google search for each to make sure that the coin did have a notable Internet presence and that there was not a lot of recent, negative news about the project.

But, before I could commence trading in this wonderful new space with lots of shiny objects, I needed some sort of trading value. Binance doesn't take fiat deposits. At the moment, they deal exclusively in Cryptocurrencies, Bitcoin being the primary pillar of value. All of the coins available on the exchange can be purchased with Bitcoin, though they offer other pairings as well, such as Ethereum and their own token (BNB).

With my list of coins to purchase, I send a little Bitcoin over directly from Coinbase, and immediately spread that into six coins, including Request Network (REQ), Moreno (XMR), IOTA, WAVES, Ripple (XRP) and once I realized that I could save on trading fees, Binance Coin (BNB). But that initial fragment of Bitcoin went much too quickly. And there were sooo many coins on my list. Other coins that I wanted to invest in. As was probably inevitable, a couple of days later, another bit of Bitcoin was transferred and more coins were purchased. And again a few days after that.. and again after that... I was hooked! Over the next couple of weeks I had spread my investment money across twenty-six different coins. For the most part, I had no idea what these coins represented, or even what the companies behind them had done or were planning to do. That was mostly irrelevant to me. I was chasing the dollar signs.

Newly added to my collection were Enigma (ENG), Neo (NEO), Verge(XVG), ARK, Stellar Lumens (XLM), Modum (MOD), Cardano (ADA), Poet (POE), Tron (TRX), Icon (ICX), VeChain (VEN), FunFair (FUN), AION, Aeron (ARN), Quantumstamp (QSP), Enjin (ENJ), and VIBE, with additional buy-ins on BNB and Ripple. It seemed as if it was impossible to pick a loser! Every coin was increasing in value. Literally. I even had a coin that tripled in value over the course of 10 days! Pretty sweet, right? Just one little problem -- I had only purchased $20 worth of this coin. So while the percentage increase was awesome, the actual fiat value coming back to me was much more sobering.

OK I thought. I can fix that. Let's siphon more Bitcoin to double down on some of these small investments. Every few days I would find myself slicing off a little bit more of my Bitcoin holdings and sending it over to Binance (after the first couple of transfers, I finally discovered the wonders of GDAX and avoiding Coinbase Fees! <Article to come on this subject>). Some of that would be spent increasing holdings in coins I already owned, but there would often be new coins added to my portfolio as well.

OK I thought. I can fix that. Let's siphon more Bitcoin to double down on some of these small investments. Every few days I would find myself slicing off a little bit more of my Bitcoin holdings and sending it over to Binance (after the first couple of transfers, I finally discovered the wonders of GDAX and avoiding Coinbase Fees! <Article to come on this subject>). Some of that would be spent increasing holdings in coins I already owned, but there would often be new coins added to my portfolio as well.

As the stash of Bitcoin dwindled, I switched to using Ethereum as

my base currency. I added OAX and Substratum (SUB) (both were actually meant to be short-term sells but I got caught holding the bags and am still holding to this day) -- Neblio (NEBL), Lunyr (LUN), ChainLink (LINK), NavCoin (NAV). I would not be stopped! Gotta catch them all!?

I was now up to three different trading exchanges (four if you separate Coinbase and GDAX), and had nearly 40 different coins/tokens! Collecting things is fun! Don't want to miss any moonshots, after all.

===

Pausing my chronological story progression for a moment, I want to talk a little about FUD.

FUD is a popular acronym in Cryptocurrency circles. It stands for Fear, Uncertainty, Doubt and is usually used to indicate a time of emotional sell-offs within the market, sometimes triggered by negative press. The fluctuations of the market can seem random at times -- perhaps even more often than not. Whether 'FUD' is indeed the cause for any sudden market drop is not always readily apparent. But, it was certainly not uncommon for general sentiment to affect a coin's value, either positively, or negatively. Here are three short tales of the latter.

The coins in particular were Verge, Ripple, and Tron.

I bought into Verge in late December. Verge had been recommended by John McAfee (who apparently holds quite a bit of influence) and seen exponential growth throughout the year. I bought on a dip, thinking myself wise. And as I expected, the value of the Verge token pulled out of the dip and saw a nice increase... for a time.

News suddenly spread that Verge (a coin focused on providing privacy) was leaking user's IP addresses. I don't think that this report was ever proven to be true, nonetheless, the coin's value plummets quickly. I don't learn of the price drop quickly enough, but I do manage to bail out just above my buy-in line (making ~4$ profit) and curse the fact that I didn't sell at a higher point.

---

As Crytpocurrencies gained traction in the news and online articles, one coin in particular that seemed to get a significant amount of press was called Ripple. For a time in late December, Ripple was the second most valuable Cryptocurrency by market cap. Rumors surged that Coinbase would be adding Ripple as its next offering and the name was on everyone's lips. The price soared and it reached an all-time high on Jan 4th.

As Crytpocurrencies gained traction in the news and online articles, one coin in particular that seemed to get a significant amount of press was called Ripple. For a time in late December, Ripple was the second most valuable Cryptocurrency by market cap. Rumors surged that Coinbase would be adding Ripple as its next offering and the name was on everyone's lips. The price soared and it reached an all-time high on Jan 4th.

But at the same time, the negative posts and articles began to appear more frequently. The founding team controlled 60% of the tokens which had not yet been released into the public; it was too centralized; banks using the Ripple network didn't need to use the Ripple token, making it valueless. .

Though the price is still climbing, the winds of popular opinion seem to be blowing the wrong way. And having just been through the Verge fiasco and coming out barely above the waterline, I decide to get ahead of this one and unload my Ripple on January 4th. The price reaches its all time high later that day, but by a week later had lost over a third of its value.

---

Then there was Tron.

At the beginning of the year 2018, Tron was vying for Lordship of the Altcoins. There was a CNBC article and a Business today article and the damn thing shot up by 150% IN ONE DAY!! It even reached a market cap of nearly 15 billion dollars! Pretty crazy for a company with no usable product.

But then the rumors began to swirl. Justin Sun (the founder) was selling off his coins; they were all marketing and no product; the Tron whitepaper had simply copied sections from other whitepapers.

Many investors choose to take their profits and the price sinks.

---

Interestingly enough, all three of these coins appeared not long after in this article about Cryptocurrencies and Vaporware.

I had learned how fickle the market could really be. And prone to emotional swings that would make Mel Gibson seem sane. But that's workable, as long a you can read the signs in a timely manner. What I would learn next though, is that the Cryptocurrency market could also deliver an experience to rival the Trials of Job. Over the next 10 days, the entire Cryptocurrency market would lose over 50% of its value and at times it would seem as if the rest of the world was determined to crush the entire industry.

Up Next... The Crash of '18.

Binance, an exchange based in Singapore, was oft-mentioned as a preferred trading spot. So on Christmas evening, I took a look. The website was in English and looked clean, professional. I stepped into the account creation flow and after a surprisingly easy and painless setup, I was ready to go. The number of available coins and trading pairs was overwhelming. But I had come prepared. There was no real research done for these choices. I went with popularity and name recognition. Follow the masses! My reasoning was as follows -- if the coin was popular, it would get more press and mentions, and more people would buy it. This was a sort of doubling-down on my belief that Bitcoin would boom because it had plenty of press, but relatively few actual investors. I combed through threads on Reddit to create an initial list of the coins mentioned most often, especially in the innumerable threads asking for advice on where to invest. Then, I ran a basic Google search for each to make sure that the coin did have a notable Internet presence and that there was not a lot of recent, negative news about the project.

But, before I could commence trading in this wonderful new space with lots of shiny objects, I needed some sort of trading value. Binance doesn't take fiat deposits. At the moment, they deal exclusively in Cryptocurrencies, Bitcoin being the primary pillar of value. All of the coins available on the exchange can be purchased with Bitcoin, though they offer other pairings as well, such as Ethereum and their own token (BNB).

With my list of coins to purchase, I send a little Bitcoin over directly from Coinbase, and immediately spread that into six coins, including Request Network (REQ), Moreno (XMR), IOTA, WAVES, Ripple (XRP) and once I realized that I could save on trading fees, Binance Coin (BNB). But that initial fragment of Bitcoin went much too quickly. And there were sooo many coins on my list. Other coins that I wanted to invest in. As was probably inevitable, a couple of days later, another bit of Bitcoin was transferred and more coins were purchased. And again a few days after that.. and again after that... I was hooked! Over the next couple of weeks I had spread my investment money across twenty-six different coins. For the most part, I had no idea what these coins represented, or even what the companies behind them had done or were planning to do. That was mostly irrelevant to me. I was chasing the dollar signs.

Newly added to my collection were Enigma (ENG), Neo (NEO), Verge(XVG), ARK, Stellar Lumens (XLM), Modum (MOD), Cardano (ADA), Poet (POE), Tron (TRX), Icon (ICX), VeChain (VEN), FunFair (FUN), AION, Aeron (ARN), Quantumstamp (QSP), Enjin (ENJ), and VIBE, with additional buy-ins on BNB and Ripple. It seemed as if it was impossible to pick a loser! Every coin was increasing in value. Literally. I even had a coin that tripled in value over the course of 10 days! Pretty sweet, right? Just one little problem -- I had only purchased $20 worth of this coin. So while the percentage increase was awesome, the actual fiat value coming back to me was much more sobering.

OK I thought. I can fix that. Let's siphon more Bitcoin to double down on some of these small investments. Every few days I would find myself slicing off a little bit more of my Bitcoin holdings and sending it over to Binance (after the first couple of transfers, I finally discovered the wonders of GDAX and avoiding Coinbase Fees! <Article to come on this subject>). Some of that would be spent increasing holdings in coins I already owned, but there would often be new coins added to my portfolio as well.

OK I thought. I can fix that. Let's siphon more Bitcoin to double down on some of these small investments. Every few days I would find myself slicing off a little bit more of my Bitcoin holdings and sending it over to Binance (after the first couple of transfers, I finally discovered the wonders of GDAX and avoiding Coinbase Fees! <Article to come on this subject>). Some of that would be spent increasing holdings in coins I already owned, but there would often be new coins added to my portfolio as well.As the stash of Bitcoin dwindled, I switched to using Ethereum as

my base currency. I added OAX and Substratum (SUB) (both were actually meant to be short-term sells but I got caught holding the bags and am still holding to this day) -- Neblio (NEBL), Lunyr (LUN), ChainLink (LINK), NavCoin (NAV). I would not be stopped! Gotta catch them all!?

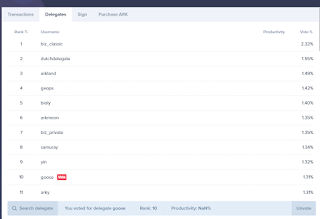

In mid-January I decided to buy-in to a project called RaiBlocks (now known as Nano). This project was oft-mentioned on Reddit and had been shilled in a convincing manner. I held out for a while hoping it would be listed on Binance. But as it seemed that day would never come, I girded my loins and prepared to venture further into the wild, targeting a much smaller exchange that offered RaiBlocks on their markets. This one was called Kucoin and seemed to also be based in the Far East, Hong Kong to be more exact. However, unlike Binance, its website wasn't quite as slick. There were poor English translations and some of the banners displayed what seemed to be Hanzi characters (much of this has been cleaned up since then). But it had enough of an air of legitimacy about it for me to proceed. Again, getting my account setup was much easier than I expected. Both Binance and Kucoin offered (and even encouraged) 2-factor authentication, which went a long way towards providing me with a sense of site and account security. I also decided to pick up some Kucoin shares, which offer a daily dividend based on the volume traded on their site, and Bounty, another well-known project that wasn't available on Binance for whatever reasons.

I was now up to three different trading exchanges (four if you separate Coinbase and GDAX), and had nearly 40 different coins/tokens! Collecting things is fun! Don't want to miss any moonshots, after all.

===

Pausing my chronological story progression for a moment, I want to talk a little about FUD.

FUD is a popular acronym in Cryptocurrency circles. It stands for Fear, Uncertainty, Doubt and is usually used to indicate a time of emotional sell-offs within the market, sometimes triggered by negative press. The fluctuations of the market can seem random at times -- perhaps even more often than not. Whether 'FUD' is indeed the cause for any sudden market drop is not always readily apparent. But, it was certainly not uncommon for general sentiment to affect a coin's value, either positively, or negatively. Here are three short tales of the latter.

The coins in particular were Verge, Ripple, and Tron.

I bought into Verge in late December. Verge had been recommended by John McAfee (who apparently holds quite a bit of influence) and seen exponential growth throughout the year. I bought on a dip, thinking myself wise. And as I expected, the value of the Verge token pulled out of the dip and saw a nice increase... for a time.

News suddenly spread that Verge (a coin focused on providing privacy) was leaking user's IP addresses. I don't think that this report was ever proven to be true, nonetheless, the coin's value plummets quickly. I don't learn of the price drop quickly enough, but I do manage to bail out just above my buy-in line (making ~4$ profit) and curse the fact that I didn't sell at a higher point.

---

As Crytpocurrencies gained traction in the news and online articles, one coin in particular that seemed to get a significant amount of press was called Ripple. For a time in late December, Ripple was the second most valuable Cryptocurrency by market cap. Rumors surged that Coinbase would be adding Ripple as its next offering and the name was on everyone's lips. The price soared and it reached an all-time high on Jan 4th.

As Crytpocurrencies gained traction in the news and online articles, one coin in particular that seemed to get a significant amount of press was called Ripple. For a time in late December, Ripple was the second most valuable Cryptocurrency by market cap. Rumors surged that Coinbase would be adding Ripple as its next offering and the name was on everyone's lips. The price soared and it reached an all-time high on Jan 4th.But at the same time, the negative posts and articles began to appear more frequently. The founding team controlled 60% of the tokens which had not yet been released into the public; it was too centralized; banks using the Ripple network didn't need to use the Ripple token, making it valueless. .

Though the price is still climbing, the winds of popular opinion seem to be blowing the wrong way. And having just been through the Verge fiasco and coming out barely above the waterline, I decide to get ahead of this one and unload my Ripple on January 4th. The price reaches its all time high later that day, but by a week later had lost over a third of its value.

---

Then there was Tron.

At the beginning of the year 2018, Tron was vying for Lordship of the Altcoins. There was a CNBC article and a Business today article and the damn thing shot up by 150% IN ONE DAY!! It even reached a market cap of nearly 15 billion dollars! Pretty crazy for a company with no usable product.

But then the rumors began to swirl. Justin Sun (the founder) was selling off his coins; they were all marketing and no product; the Tron whitepaper had simply copied sections from other whitepapers.

Many investors choose to take their profits and the price sinks.

- https://themerkle.com/tron-price-drops-by-nearly-50-in-5-days-as-pump-runs-out-of-steam/

- https://themerkle.com/tron-price-keeps-getting-battered-as-0-11-doesnt-turn-into-support/

---

Interestingly enough, all three of these coins appeared not long after in this article about Cryptocurrencies and Vaporware.

I had learned how fickle the market could really be. And prone to emotional swings that would make Mel Gibson seem sane. But that's workable, as long a you can read the signs in a timely manner. What I would learn next though, is that the Cryptocurrency market could also deliver an experience to rival the Trials of Job. Over the next 10 days, the entire Cryptocurrency market would lose over 50% of its value and at times it would seem as if the rest of the world was determined to crush the entire industry.

Up Next... The Crash of '18.

Comments

Post a Comment