Crypto Tales Part 1 - What Could Have Been

In the summer of 2010, while on a plane trip, I happened across a magazine article that talked about this strange new technology called Bitcoin. Though I had no idea what a blockchain was, nor did I fully understand how one could trust a non-centralized, distributed payment system, nonetheless, I was still intrigued by what I had read. Perhaps I would look further into this at a later point. And mining sounded like an interesting avenue for exploration. After all, it was free coins, right?

But alas, crap did befall, my worldly possessions were at an unknown position in transit for two weeks as I moved halfway across the country, and Bitcoin slipped entirely from my mind.

...

Many years later, another article did catch my eye. This time it was of the online variety, and it spoke of how Bitcoin had surpassed $1000 in value! Holy crap, Batman! If only I had invested $100, or even $20 back in 2010... but then I try to think more rationally and realize that I had I indeed invested 7 years prior, I likely would not have held onto those coins for this long.

C'est la vie, as they say. The ship has obviously sailed on that one. No way that crazy digital currency is worth more than a thousand dollars!

The months go past and Bitcoin news and articles become more frequent. The value continues to skyrocket. Six thousand in June! Eight thousand in November! Well shit. It doesn't seem like the price increases are going to stop anytime soon. I need to get onboard this money train!

But still I'm hesitant. I tap into a cryptocurrency chat room with some folks from work, but their chatter of secure hardware wallets and stamping their private keys into metal plates leave me a bit leery of the whole scene. I continue to lurk and hear of a US-based exchange called Coinbase. Their website is clean and professional, and includes a claim of being FDIC insured! Aha! This is what I was looking for. A seemingly trustworthy third party who will handle all this wallet nonsense for me and just let me get down to the business of counting the money that will surely start piling up once I throw my hat into the ring.

But still, I am hesitant. Finally, I talk myself into making the leap. I notice that Bitcoin talk is everywhere -- but few that I know have actually invested, and I work in tech company. So, it stands to reason that as the press continues more people will buy in and the price will continue to rise. This will work for me. Six months, I tell myself. I expect to double my investment in sixth months, at which point I will take out half, and continue on with the remaining share .

Alas, getting my bank account verified takes longer than it should, and I don't want to pay extra for credit card fees (which may have been fortuitous considering the credit card blowback that came in early 2018). All in all, it takes about a week for me to get rolling, during which, of course, Bitcoin continues to increase in value.

I'm finally cleared on Dec 4th, 2017, and I split my money 40%/40%/20% amongst Litecoin, Ethereum and Bitcoin. I knew little to nothing of the first two, but since they were offered, I felt it best to diversify my investment a bit.

Due to the delays in getting my account setup and verified, I wasn't able to buy in until the price had reached $11,600 USD, a good two thousand above the point at which I had decided to go for it. The Fear Of Missing Out syndrome was already in my head. After all, I had missed out 10 years before, then again ever since. Damnit! I was not going to miss out this time!

So that led to further buy-ins as soon as I was able. I bought in twice more over the next few days. My portfolio value was already up by 60% after 10 days! Hell yeah! Forget my original six months plan... I was going to double my money in a few weeks and pay off my mortgage in a year!

Bitcoin continued its meteoric rise, even hitting a value 20 thousand and I was walking on sunshine for those two weeks. But soon after the 20k milestone, Bitcoin value took a step back to 18 thousand and I bought in again, thinking it was only a temporary dip on our perpetual moon ride. Prices continued to fall dramatically over the next few days, dipping below 11 thousand right before Christmas. This was not what I had requested of Santa.

Shaken by this turn of fortune, I began to take a closer look at my holdings and realized that I actually wasn't getting a lot of gain from Bitcoin anymore. Most of my untaken profits lay in Litecoin and Ethereum, both of which had more than doubled in value since my initial buy-in.

By this time, I had become a regular lurker on reddit.com/r/cryptocurrency and begun learning about all of the other coins out there, many of which were gaining value at ludicrous rates! That's where I needed to be, I thought. In the deeper water, where the waves crest higher, but where one also has to be willing to play with the whales and the sharks.

...to be continued...

But alas, crap did befall, my worldly possessions were at an unknown position in transit for two weeks as I moved halfway across the country, and Bitcoin slipped entirely from my mind.

...

Many years later, another article did catch my eye. This time it was of the online variety, and it spoke of how Bitcoin had surpassed $1000 in value! Holy crap, Batman! If only I had invested $100, or even $20 back in 2010... but then I try to think more rationally and realize that I had I indeed invested 7 years prior, I likely would not have held onto those coins for this long.

C'est la vie, as they say. The ship has obviously sailed on that one. No way that crazy digital currency is worth more than a thousand dollars!

The months go past and Bitcoin news and articles become more frequent. The value continues to skyrocket. Six thousand in June! Eight thousand in November! Well shit. It doesn't seem like the price increases are going to stop anytime soon. I need to get onboard this money train!

But still I'm hesitant. I tap into a cryptocurrency chat room with some folks from work, but their chatter of secure hardware wallets and stamping their private keys into metal plates leave me a bit leery of the whole scene. I continue to lurk and hear of a US-based exchange called Coinbase. Their website is clean and professional, and includes a claim of being FDIC insured! Aha! This is what I was looking for. A seemingly trustworthy third party who will handle all this wallet nonsense for me and just let me get down to the business of counting the money that will surely start piling up once I throw my hat into the ring.

But still, I am hesitant. Finally, I talk myself into making the leap. I notice that Bitcoin talk is everywhere -- but few that I know have actually invested, and I work in tech company. So, it stands to reason that as the press continues more people will buy in and the price will continue to rise. This will work for me. Six months, I tell myself. I expect to double my investment in sixth months, at which point I will take out half, and continue on with the remaining share .

Alas, getting my bank account verified takes longer than it should, and I don't want to pay extra for credit card fees (which may have been fortuitous considering the credit card blowback that came in early 2018). All in all, it takes about a week for me to get rolling, during which, of course, Bitcoin continues to increase in value.

I'm finally cleared on Dec 4th, 2017, and I split my money 40%/40%/20% amongst Litecoin, Ethereum and Bitcoin. I knew little to nothing of the first two, but since they were offered, I felt it best to diversify my investment a bit.

(cryptocurrency icons courtesy of Lukasz Adam)

Due to the delays in getting my account setup and verified, I wasn't able to buy in until the price had reached $11,600 USD, a good two thousand above the point at which I had decided to go for it. The Fear Of Missing Out syndrome was already in my head. After all, I had missed out 10 years before, then again ever since. Damnit! I was not going to miss out this time!

So that led to further buy-ins as soon as I was able. I bought in twice more over the next few days. My portfolio value was already up by 60% after 10 days! Hell yeah! Forget my original six months plan... I was going to double my money in a few weeks and pay off my mortgage in a year!

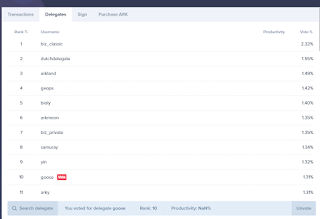

|

| Bitcoin prices in Q4 2017 |

Shaken by this turn of fortune, I began to take a closer look at my holdings and realized that I actually wasn't getting a lot of gain from Bitcoin anymore. Most of my untaken profits lay in Litecoin and Ethereum, both of which had more than doubled in value since my initial buy-in.

By this time, I had become a regular lurker on reddit.com/r/cryptocurrency and begun learning about all of the other coins out there, many of which were gaining value at ludicrous rates! That's where I needed to be, I thought. In the deeper water, where the waves crest higher, but where one also has to be willing to play with the whales and the sharks.

...to be continued...

well, that's a great blog. Really so much impressive and i love that type of post. thank you.

ReplyDeleteIf you searching for a legit financial service .Check it out. Link below.

legit dark web

Unclaimed Mystery Box

legit PayPal transfer dark web

dark web financial services .

Please carry on and keep blogging . Thanks again